What is Bitcoin? Everything about Bitcoin

It all started in 2008 with the publication of an article that introduced an electronic currency called Bitcoin. The anonymous identity of Satoshi Nakamoto was the initiator of a revolution that years later became the headline of the media, forcing economists to debate it extensively.

Bitcoin was the first digital currency to initiate decentralization in the post-Internet world.

Bitcoin can be the kind of money you use to buy or order online, or it can be seen as an investment that preserves the value of your savings in the long run, or a platform for decentralized programs in the future which enter into the non-financial aspects of your life.

Along with the tempting rise in the price of cryptocurrencies, you may have heard about the king of cryptocurrencies in the news and cyberspace, and while browsing various websites, you may come across topics such as what Bitcoin is or how you can get free Bitcoin.

But apart from the discussion of free Bitcoins, which is by no means an interesting starting point for getting acquainted with such a large phenomenon, in this article Poolyab cryptocurrency magazine we are going to explore this monetary and technological revolution and examine it from every angle. Join us to answer the questions you have in mind about this cryptocurrency.

What is Bitcoin?

Bitcoin is an electronic currency with which you can send money anywhere in the world or use it to buy goods and services.

The two main features of Bitcoin, namely decentralization and the avoidance of printing more monetary units, are important achievements for today’s currencies that pave the way for a new form of economic system in the future. Bitcoin can be considered an investment tool, with which you can make your currency transfers and even order from online stores. The same different functions and different uses that you can have from Bitcoin may be the most important reason and the best answer to the question of why you should be more familiar with this phenomenon.

We referred to this cryptocurrency as a kind of money. So to better understand it, we first need to get a little familiar with money and its history.

Money History

Thousands of years ago, after cavemen began farming and raising livestock, they faced new challenges. The need for food for the first humans, which was their most basic need, was often met by hunting animals or using fruits and plants. With the beginning of animal husbandry and breeding, and on the other hand agriculture and the planting of the seeds of edible plants, the products that were raised and produced by humans also increased. With the rise of these products and the fact that many of these foods had a lifespan that would spoil over time, humans began to exchange goods, which was the prelude to the emergence of money.

The exchange of goods with goods had problems, including the difficulty of transporting the exchanged goods and the difference in their value. The farmer who wanted to get a sheep from a rancher did not know exactly how many bags of wheat he would have to pay for it. These problems led to the creation of an intermediary tool called money, the shape of which changed many times over time.

The people of each region of the globe used their own area coins, which were often obtained directly from nature. At some point in history, salt was used in many areas as an intermediary to determine the value of various commodities, in some areas seashells, and even for a period of time, cotton was used as money. But each of these currencies was devalued and discarded after a rich source was discovered.

The evolutionary cycle of money continued with the rise and fall of all kinds of currencies until the arrival of gold and silver coins. Because of their durability, limited resources, and difficulty to forge, these metals have been used for more than a thousand years as money in various empires and governments engraved with coins depicting their kings. But coins also had their own problems; carrying them because of their heavyweight was a challenge for metal coins. To solve the problem of carrying coins, centers were set up that received coins to give receipts and paper documents to merchants, which showed that in return they could receive coins only by giving these receipts to other centers.

The evolution of these paper receipts led to what we now know as banknotes. At first, the value of each banknote was determined by a certain amount of precious metals, but today this is no longer the case. It is good to know that today’s banknotes that you buy or keep in your bank account have no backing and that is why they are called unsupported money or Fiat. In other words, the reason why today’s paper money or digital numbers in your bank account are valuable goes back to the credit of the government that prints and sells them. But what is the place of this digital currency in the brief history of the origin and evolution of money? And why should it be considered a continuation of this cycle?

Who controls Bitcoin?

Unlike today’s currencies, which are supplied and distributed by governments, Bitcoin is not controlled by any particular individual, group, or organization. People who enter the network of this cryptocurrency must accept the rules of the network. These rules are in the form of programming codes that can be seen by everyone on the Internet.

There are several groups in the Bitcoin network, the most important of which are miners (the same people you probably saw with shovels and pickaxes who have no resemblance to these photos at all!), Developers (programmers responsible for improving software Bitcoin (voluntarily taken over) and network nodes (devices connected to the network) were mentioned.

Each of these groups has a specific task in the network; For example, miners confirm the transfer of Bitcoins, also called transactions, on the network. Or developers are voluntarily responsible for upgrading Bitcoin software and its capabilities. Nodes also store the history of network transactions on their hard drives.

Bitcoin is not controlled by any of these groups, governments, or other specific individuals, and the cooperation of the various groups present in the Bitcoin network will keep it alive and growing. But why should there be such a complex system? What are the problems with traditional banks and financial systems that lead us to use Bitcoin?

What is the purpose of Bitcoin?

In short, the purpose of Bitcoin is to securely transfer or store money. Therefore, it can be considered a secure digital payment and banking system. Bitcoin restores real money control to individuals, and with a special password called a private key, only the owners of those keys will be able to spend and transfer the Bitcoins.

On the other hand, digital money has always faced a big problem called “double spending”. This was not the case with paper money and physical money, for example, you could not re-use the money you spent on a TV to buy another product. But in a digital world where you can copy everything with just one click, it is important to avoid double-spending. If digital money is like a file, you can spend it in two separate places at the same time and you have made your purchases so that the sellers know about it. That’s why before the advent of digital currencies, there was always a central body to check individuals’ inventories to prevent this from happening. But with the advent of this digital currency, the existence of a central organization was eliminated and transactions were checked by all members of the network. So another important goal of Bitcoin is to solve the problem of double-spending without trusting someone else.

Who made Bitcoin?

Bitcoin was born in late 2008. You probably remember the big financial crisis of 2008 and the events of that time from the news. It was around this time that an unknown individual or group, alias Satoshi Nakamoto, sent an article to a large number of cryptographers talking about new electronic money. In this article, also known as the White Paper, Satoshi Nakamoto described Bitcoin and how it works.

A few months later, in early 2009, the Bitcoin network began operating. Satoshi Nakamoto was in the early years of the project, fixing its shortcomings with other developers joining the project until it disappeared in late 2010.

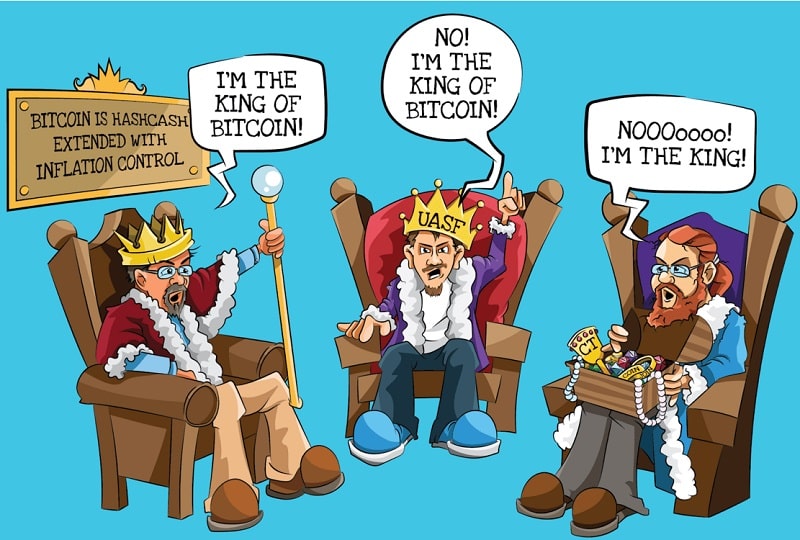

More than 10 years after the creation of Bitcoin, the identity of Satoshi Nakamoto has not yet been determined. Satoshi Nakamoto can be an individual, a group of programmers, or even a secret government organization. There are many hypotheses about Satoshi Nakamoto’s identity, and many more claimants have identified themselves as Satoshi Nakamoto. However, none of them have enough evidence to prove their claim.

- Why did Satoshi Nakamoto keep her identity secret?

Satoshi Nakamoto kept her identity secret and probably had good reasons for doing so. One possible reason is that Satoshi Nakamoto’s life is in danger due to Bitcoin. As we will discuss the features of Bitcoin later, this economic innovation can bypass large banks and financial institutions and therefore could have many enemies from the beginning. If the identity of the creator of Bitcoin is known, the possibility of arrest and exposure to various dangers could befall the individual or group that created it.

On the other hand, it was said that Bitcoin is not under anyone’s control. This feature, known as decentralization, which we will discuss in more detail later, is mentioned in one of Satoshi Nakamoto’s emails, which is only realized when he hides her identity. If the identity of the creator of Bitcoin was not unknown, then Satoshi Nakamoto’s ideas could have greatly influenced the network during the development process and taken it out of decentralization.

- Was Bitcoin made by the US National Security Agency?

One of the most controversial hypotheses about the constructive identity of the king of cryptocurrencies goes back to the US government. According to this hypothesis, Bitcoin is a pilot project created by the NSA to prepare the available space and later introduce cryptocurrency, which is completely controlled by the US government. Even one of the founders of the Kaspersky Security Company reiterated this hypothesis. But to what extent can this be true?

Many parts of Bitcoin encryption use functions designed by the NSA. Satoshi Nakamoto is also likely to have more than one million Bitcoin coins. So if you are a skeptic who is also interested in conspiracy theories, you probably believe this hypothesis. But you should know that the worst thing the NSA could have done was to create a cryptocurrency that no one can control! On the other hand, who Satoshi Nakamoto was should not be a big deal because everyone can see the Bitcoin software code and the rules are clear to everyone. Those who want to break these rules will be blocked by the network.

What is Bitcoin backed by?

Surely the question has arisen for you, what is Bitcoin backed by? In answer to this question, it must be said that nothing; Bitcoin has no support! While backing can be a misnomer, one question is, what do you think is the backing of the currencies you use every day and currencies like the dollar and the euro? The answer to this question is nothing.

Unlike today’s currencies, Bitcoin is not backed by precious metals such as gold or commodities. The fundamental value of Bitcoin and backed currencies stems from the trust of people who believe they are valuable. Just as you believe that you can give your banknotes to the shop and buy the goods you need, so the shopkeeper knows that by giving these banknotes he can buy the goods he needs, so these banknotes go hand in hand in society.

But on the other hand, looking at the use of Bitcoin in today’s world, we can see that most people buy Bitcoin to invest and not to use it in their payments. This is why there is another view that bitcoin, in addition to being a currency, can also be used as an asset; An asset that can maintain its value over time. For example, the value of gold against basic commodities such as food and clothing has been almost constant over time. Accordingly, Bitcoin can be considered an asset, considering the features that we will introduce in full below. But how is Bitcoin valued and who determines the price of Bitcoin?

- How is Bitcoin valued?

The value of Bitcoin is not determined by a particular individual or group. Just as the price of gold in world markets is determined by supply and demand, the price of Bitcoin in exchange offices and brokerages is determined by the two main factors of supply and demand. If market power is greater than demand, prices will move downward until demand equals supply again.

On the other hand, this cryptocurrency can be considered as having a fundamental value, the amount of which is obtained according to the condition of its network and the cost that miners spend to extract a unit from it. Despite the different valuation methods, the price of Bitcoin is ultimately determined by the supply that can be generated by the miners or the demand generated by the investors.

What distinguishes Bitcoin?

Transferring Bitcoins and spending them does not require permission from banks or any other institution. On the other hand, you may have heard that Bitcoin is the money of criminals and is used to remain anonymous in criminal activities. But aside from the misnomer attributed to Bitcoin by newspapers, news, and the media, this cryptocurrency has features that set it apart from other physical cryptocurrencies. The basic and important features of Bitcoin are described below:

No one is in power

To understand the nature of decentralization, it may be best to first become familiar with centralization and better understand the implications of having a centralized system in the monetary and financial system. Being focused means that when you go to the bank, the payment system may be down (right or wrong!) And you will be delayed for hours to do your banking. A centralized system means that governments have control over money, and the harmful effects of such control, such as inflation and devaluation of money, are not hidden from anyone. A centralized system means that banks can close your account without your knowledge. Finally, the centralization of the monetary system means that one country has the power to impose sanctions and exclude another from the cycle of financial transfers.

But the most important feature of Bitcoin is its decentralization. As mentioned, Bitcoin is not controlled by any individual, group, organization, bank, or government. The decentralized nature of Bitcoin means that power in the network is distributed among individuals. This power can be the power to create and distribute money that has been taken out of the hands of the banks and returned to the people. Accordingly, the trust you had in third parties and intermediaries such as banks in transferring money is also distributed among all the people who oversee the transactions, and so-called you trust a system; A system whose rules are written in programmed code and you can use it voluntarily.

The decentralized nature of Bitcoin initially led people who realized the weakness of financial systems in the 2008 financial disaster to turn to technology. The power that banks gained in controlling and supplying money, and the inflation that led to it, was one of the reasons for the emergence of Bitcoin.

The number of Bitcoins is limited

Governments and central banks have the power to print money indefinitely, thereby devaluing their national currencies. In the Bitcoin network, although everyone can participate in the creation of new currencies, the total number of coins that can be made can be up to 21 million units. The Bitcoin network rules are limited by the limited number of Bitcoin coins and the impossibility of creating more Bitcoins than miners are allowed to mine in each block. Of course, generous miners may not receive their mining rewards, reducing the total number of Bitcoin coins to less than 21 million. For example, in block number 124724, one of the miners did this and received a lower reward (one less Satoshi).

New Bitcoins are generated and released online through a process called mining. You may have seen this process in photos of tired miners digging into the rocks with a shovel and pickaxe and pulling out coins with the B mark or Bitcoin. But this process is completely different from what is shown in these photos, and we will describe it later. The mining of Bitcoins decreases over time and therefore the extraction of new units becomes more and more difficult. One of the main reasons that make it valuable over time, or in other words its price increase, is its limited nature.

This feature, which makes Bitcoin scarce, contrasts with the inflationary nature of today’s currencies, whose value gradually decreases over time. Of course, the limited number of Bitcoins has led to it being referred to as a tool that can store value over time. Investors’ interest in buying Bitcoins and attributing titles such as digital gold to it is proof of this.

Transactions are semi-anonymous

In electronic and banking payment systems, customers usually need to register or open an account with their identification details. But in Bitcoin, the situation is different, and creating an account, or rather a new wallet address, can be done in just a few seconds. You will not be asked for your identity information, national code, and similar details on this network, but this should not confuse you that Bitcoin is an anonymous system and your activity will be secret. Although you can create a large number of addresses every minute and send them Bitcoins, you should know that these transactions are not anonymous. It is better to say that Bitcoin transactions are semi-anonymous (something between anonymous and anonymous).

Bitcoin transactions are transparent and any transaction made on the network can be seen by everyone. This means that anyone can track a transaction, but this does not mean that the identity information of individuals is identified and only the addresses with their receipts and submissions can be viewed. However, cryptocurrency exchanges, where Bitcoin is traded mainly, try to authenticate their users to prevent criminal activities and issues such as money laundering, so that they can use it in case of any crime with coins bought or sold and pursue through legal authorities. For this reason, Bitcoin is not a good tool for criminal activity and transactions can be tracked.